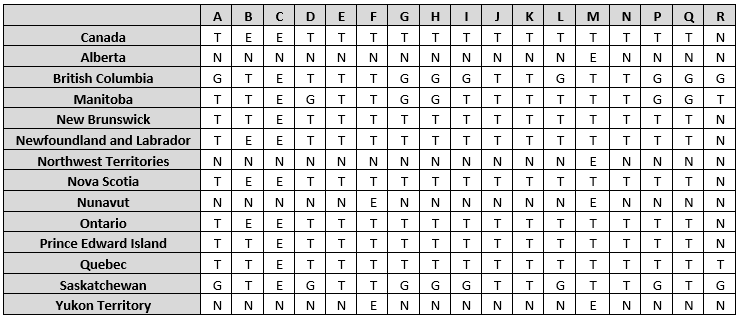

avalara tax code matrix

Iowa law did not reference a zip code-based database when providing for relief from liability for errors with the information provided by the state. Understand the exemption matrix CertCapture 3 min FREE.

Us Based Avalara Acquires Ai Start Up Indix Machine Learning Artificial Intelligence Learn Artificial Intelligence Artificial Intelligence

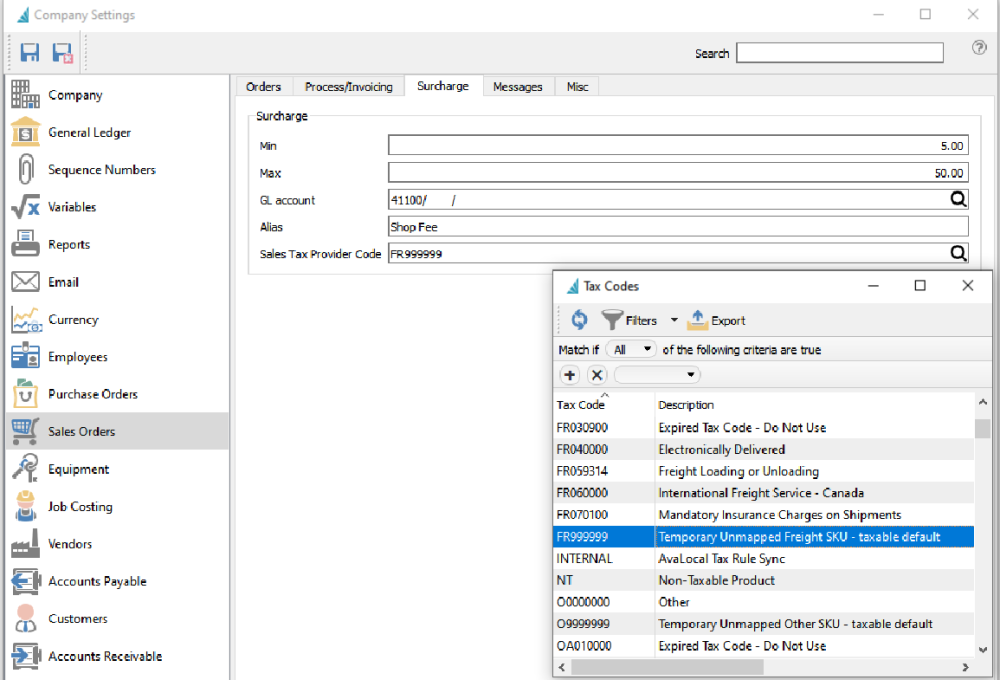

Most Avalara tax codes are made up of eight characters.

. Map the items you sell to Avalara tax codes Avalara Connector for NetSuite 7 min FREE. Software programming services for business use NEW. Content is shown for demonstration purposes only and is subject to change.

Setup 5 of 9. The six numbers indicate subcategories under the tax code category. Avalara Tax Research divides the content for each country by industry making it even easier to find your answers.

The exemption matrix is a central location to manage your companys exemption rules in CertCapture. Understand the exemption matrix CertCapture 3 min FREE. The tax codes activated provide more granular support for many types of products and services.

Iowa has been a full member of the Streamlined Sales Tax since October 1 2005. 7500 x 001 075. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell.

CertCapture 3 min. AvaTax System Tax Codes in blue font are typically generic and thus conservative. This code may produce a fully taxable result in states.

Setup 4 of 6. In order to provide you with the most accurate sales tax calculations possible we are activating over 400 new tax codes as of October 1 2013. AvaTax System Tax Codes AvaTax System Tax Code AvaTax System Tax Code Description Additional AvaTax System Tax Code Information Note.

Using UPC commonly known as bar codes Avalara MatrixMaster determines taxability information for millions of. Setup 6 of 8. Industrial production or manufacturers.

You can copy and paste a code you find here into the Tax Codes field in the Items or What you sell areas of AvaTax when you are logged into the service or into the appropriate field in your accounting or POS system. The calculation for the larger portion taxed at the reduced rate is. Tax codes PM020704 and PM020700 must be used with this code to apply state-mandated reduced rates for manufacturers in Alabama Louisiana and Mississippi.

All rights reserved Terms and Conditions. 2022 Avalara Inc. Effective July 1 2012 South Dakota submitted an updated Taxability Matrix to the Streamlined Sales and Use Tax organization.

View exempt reasons and exposure zones where you need to collect documents view excise or withholding documents and modify expiration dates. Tracking product taxability is complicated. MA has been in our DNA since our founding.

The Service Output of AvaTax Mapping is a file containing the mapping in a format that Customer can upload to AvaTax or Customers system. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell. To assign an Avalara product tax code to a variant log into your Avalara account click Settings in the upper-right of the admin screen then click Manage items with special tax treatment.

The total freight charge is 10000 and the total tax on freight is 231. Add the AvaTax tax code to your customers Avalara Connector for NetSuite 6 min FREE. Construction servicesmaterial relating to real property existing construction commercial Freight Tangible personal property TPP Nontaxable service expenses Reimbursed travel expenses associated with installation or.

Learn how Avalara can help your business with sales tax compliance today. The second letter indicates the tax code category for example C for clothing. Iowa Taxability Matrix Updated.

Ad Solutions to help your business manage the sales tax compliance journey. AvaTax System Tax Codes AvaTax System Tax Code AvaTax System Tax Code Description Additional AvaTax System Tax Code Information Note. Avalara Streamlined Sales Tax.

Setup 4 of 6. Map what you sell to Avalara tax codes AvaTax 10 min FREE. CertCaptures Exemption Matrix contains standard Entity Use Codes and exempt reasons.

See Avalaras Import and map items to tax codes to learn more. Avalara has acquired UPC Matrix Master the worlds largest database of Universal Product Codes with specialized sales taxability dataThis purchase combined with tens of thousands of recently acquired fully researched and maintained product tax codes from leading industry partners along with its own content library accelerates Avalaras drive to. Sellers and certified service providers are relieved from tax liability to the member state and its local jurisdictions for having charged and collected the incorrect amount of sales and.

Find intuitive research for companies doing business in Europe and beyond with global tax rates for over 190 countries. Find the Avalara Tax Codes also called a goods and services type for what you sell. New Tax Codes coming October 1 2013.

In addition to our internal investments our strategy includes acquiring content products teams and leaders through MA. 2500 x 00625 156. Note that no tax codes are being retired as part of this effort.

25 of 10000 2500. This change was effective in Avalara products on April 1 2018. You can copy and paste a code you find here into the Tax Codes field in the Items or What you sell areas of AvaTax when you are logged into the service or into the appropriate.

75 of 10000 7500. With a powerful database of over 15 million codes Avalara MatrixMaster is the worlds largest database of Universal Product Codes UPC with specialized sales taxability data. The calculation for the smaller portion taxed at the regular rate is.

AvaTax System Tax Codes in blue font are typically generic and thus conservative. Understand the exemption matrix. Add the AvaTax tax code to your customers Avalara Connector for NetSuite 6 min FREE.

Two letters to start and six numbers at the end. Telecom installation Services provided TO telecom service providers NEW. A more specific AvaTax System Tax Code in the category should be chosen if possible.

Setup 8 of 9. Setup 8 of 9. We will continue to be an opportunistic and purposeful strategic acquirer.

Last year an issue was raised when Iowa recertified last year. From here you can add items one-by-one or import items in bulk using a CSV file. A more specific AvaTax System Tax Code in the category should be chosen if possible.

AvaTax Mapping formerly known as Avalara Tax Code Mapping or Avalara Tax Categories means the Service for mapping Items to Avalara AvaTax codes and other taxonomies as applicable. The first letter indicates the tax code type P for products D for digital Fr for freight S for services O for other. Avalara MatrixMaster makes it easy.

Avalara Announces Low Code Developer Tools And New Apis To Embed Compliance Into Business Applications And Ecommerce Platforms Cpa Practice Advisor

Nexus And The Sales Tax Puzzle Avalara Video Encore Business Solutions

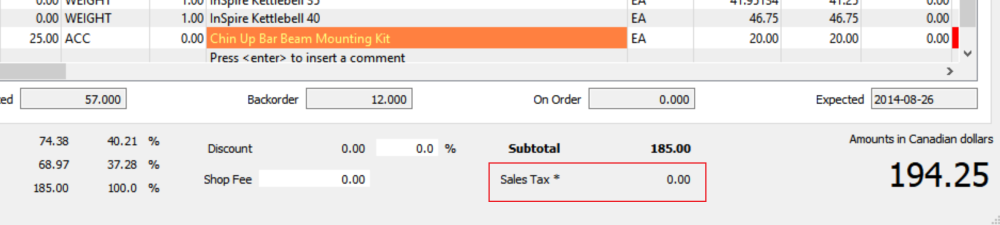

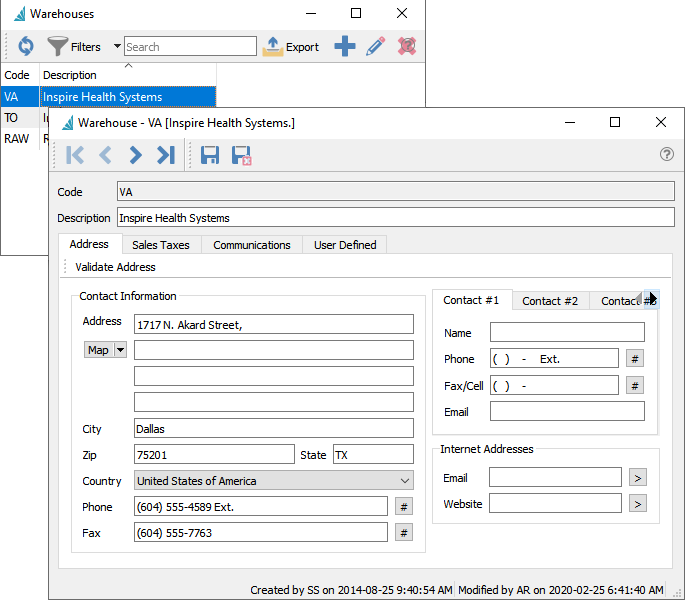

Avalara Sales Tax Spire User Manual 3 5

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

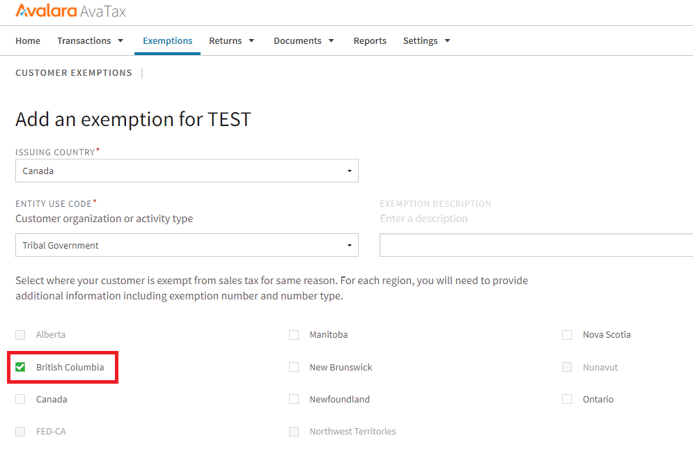

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

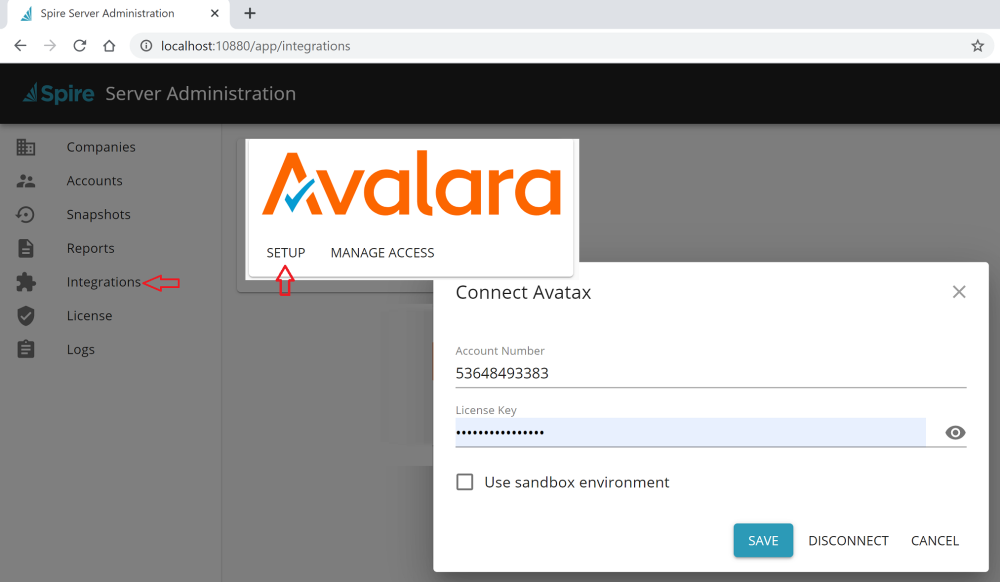

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5

Setup Avalara Avatax Agoracart

Avalara Sales Tax Spire User Manual 3 5

Understanding Freight Taxability Avalara Help Center

Use The Exemption Matrix To Customize Your Settings Avalara Help Center

Avalara Announces Low Code Developer Tools And New Apis To Embed Compliance Into Business Applications And Ecommerce Platforms